Rayven for Finance Automation + Custom Apps.

Streamline, automate + improve: get time to do what matters.

Rayven’s software enable finance and accounting teams to improve accuracy, identify risks + deliver accurate, real-time insights with accounting automation, custom apps, and AI.

Join the organisations big + small achieving more with Rayven:

Rapidly connect all your systems and create custom automations + AI Agents the easy way.

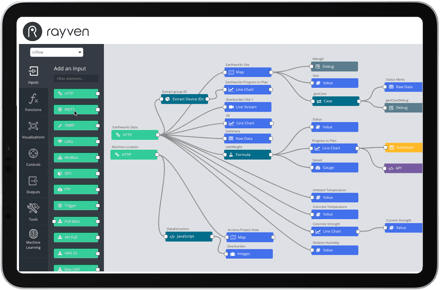

Our Rayven Platform is an all-in-one toolkit that enables you to create automations and custom apps with universal interoperability, real-time + custom AI capabilities.

We make it easy to integrate data sources, build workflows + deliver better financial intelligence - freeing teams to focus on improvement, not admin.

Just 8 of the reasons Finance & Accounting Teams love Rayven:

Automate Invoicing, Payroll, Reconciliation + More.

Get Real-Time Cash Flow Forecasting.

Instant Expense Monitoring + Anomaly Detection.

Explore Data, Ideas + Trends via AI Agents.

Eliminate Spreadsheet Chaos.

Faster Month-End Close.

Live Financial Health Dashboards.

Automated Compliance + Reporting.

Rayven has free + low-cost options, making it affordable for every business.

Automate Everything: streamline expenses, payroll, invoicing, billing, reconciliation, inventory - anything.

Manual finance processes - expense management, payroll, invoicing, and supply chain accounting - drain resources and cause errors.

Rayven automates approvals, reconciliation, and reporting; ensuring payroll accuracy, eliminating invoicing mistakes + integrating supply chain tools for real-time insights.

By cutting complexity and minimising manual work, automation keeps finance teams efficient and in control.

AI Agents: train & deploy AI Agents that streamline processes and empower your people.

Rayven’s predictive and conversational analytics empower finance teams with instant insights and smarter decision-making.

Utilise our AI agent to ask questions about transactions, automate tasks, deliver instant insights, identify trends, discuss how you can optimise cash flows + mitigate financial risks, and much more - think ChatGPT trained on your business + refreshed with your data in real-time.

Here are some example prompts you could use:

- “What’s our current cash flow position compared to last month?” Instant cash flow insights for better liquidity management.

- “Identify any unusual transactions in the last 30 days.” Detects fraud risks and prevents financial losses.

- “Generate a report on overdue invoices and outstanding payments.” Speeds-up collections and improves cash flow.

- “Predict next quarter’s revenue based on current trends.” Enables proactive financial planning and forecasting.

- “How do our operating expenses compare to budget forecasts?” Helps control costs and optimise spending.

- “List high-risk transactions flagged in the last week.” Enhances compliance and risk management.

- “What’s our expected tax liability for the next financial year?” Ensures accurate tax planning and regulatory compliance.

- “Summarise key financial KPIs for the board report.” Provides quick, data-driven insights for leadership decisions.

By simplifying data analysis + enhancing real-time decision-making, Rayven's AI Agents help finance & accounting teams stay agile.

Integrate Anything: upload, collate & analyse all your data sources in real-time.

Rayven can unify all your financial (+ business) data and systems to deliver real-time dashboards for complete visibility.

Upload spreadsheets, documents, and PDFs; collect data via forms; or integrate with existing tools to automate workflows. Create custom logic and alerts highlight issues, risks, and anomalies instantly.

Rayven enables finance teams to stay informed, proactive + in control at all-times.

Transformation With Purpose: replace spreadsheets, forms, manual reporting, legacy systems + more when you're ready to.

Rayven lets finance teams modernise at a pace that suits them, seamlessly replacing spreadsheets, forms, manual reporting + legacy systems step-by-step.

Start by integrating real-time data into live dashboards; then automate key processes to reduce errors and improve efficiency; before adding AI Agents for driving insights, alerts, and all-new automations.

Rayven ensures finance teams stay in control while transforming to a smarter, more accurate + future-proofed approach.

Are you ready to report on ESG? Rayven makes it simple for finance teams to report against sustainability frameworks:

Rayven's has everything you need to succeed - all without IT: take control + start automating today.

SaaS or self-hostable

Integrates with anything, guaranteed

No- and low-code configuration options

24/7 support + Knowledge Base

Add AI decision-making anywhere

Build automations for anything

Eliminate manual processes to reduce errors + workloads.

Get total, real-time visibility

to improve decisions.

Use AI to explore data, spot fraud + forecast.

Automate reporting + compliance, simply.

Streamline + future-proof your financial teams.

Easy-to-use: deploy without relying on IT, fast.

Remove the risks, costs + delays from building automations + applications: we can create it for you.

At Rayven, we don’t just provide the tools - we can integrate your systems, build workflows + create the apps you need from concept to deployment and beyond.

Regardless of your challenge, our expert team can deliver a bespoke app tailored to your needs in weeks that delivers an even bigger ROI, faster.

Rayven + finance automation FAQs.

Finance automation refers to the use of technology to streamline and execute financial tasks traditionally done manually. It enhances efficiency by automating workflows such as invoicing, payroll, data reconciliation, and financial reporting.

No. Rayven’s platform is designed for HR professionals, not developers. You can build workflows, automate tasks, and create custom HR apps using an intuitive, no-code interface - without IT support.

Tasks that are repetitive, time-consuming, and error-prone are ideal for automation. These include accounts payable and receivable, expense tracking, payroll, tax calculations, and financial data validation.

Automated systems eliminate human input mistakes by standardising data entry and calculations. This ensures consistency across reports, reduces discrepancies, and enhances financial integrity.

Yes, finance automation simplifies compliance by enforcing structured workflows, generating audit-ready records, and ensuring financial activities adhere to legal and industry standards - minimising compliance risks.

Yes. Rayven connects seamlessly with your existing finance, HR, CRM and any other tool or platforms. It acts as a central hub, unifying all your systems so data flows automatically - no more manual data transfers.

AI enhances automation by providing predictive analytics, detecting anomalies, and enabling natural language interactions. This improves forecasting accuracy, identifies risks, and automates complex decision-making processes.

With Rayven, finance teams can build a range of custom, real-time finance apps that automate workflows, improve data accuracy, and enhance decision-making. Here are some examples:

- Automated Expense Management: Streamline approvals, track spending, and flag anomalies in real time.

- Cash Flow Forecasting: Use AI-driven predictive models to monitor liquidity and plan for future financial needs.

- Invoice and Billing Automation: Automate invoicing, payment tracking, and reconciliation to reduce errors and late payments.

- Payroll Processing & Compliance: Ensure accurate payroll calculations, automate tax reporting, and stay compliant with regulations.

- Real-Time Financial Dashboards: Consolidate data from multiple sources into live dashboards for instant financial insights.

- Fraud Detection & Risk Monitoring: Leverage AI to detect unusual transactions and mitigate financial risks.

- Regulatory & Compliance Reporting: Automate financial reporting, ensuring accurate, audit-ready records.

Rayven’s no-code platform allows finance teams to integrate their existing systems and data sources, eliminating manual processes and enabling smarter, faster financial management.

Rayven is built for fast deployment. You can start automating processes, integrating systems, and building custom apps in days - not months. Our team ensures a smooth setup, so you see results quickly with minimal disruption.

Rayven starts free, so you can explore automation at no cost. Our flexible pricing scales with your needs, offering cost-effective solutions for SMBs and fully customisable enterprise plans - pay only for what you use.

Unlike other tools, Rayven offers total interoperability, real-time analysis, AI-powered automation, document parsing, dynamic online forms, and full system integration - all in one easy-to-use platform.

No third-party tools, no complex setup - just seamless, intelligent finance tools.